Kelly Criterion Blackjack Betting System

The Kelly criterion is a mathematical formula for strategically making bets. You may be asking: what is the Kelly criterion? The Kelly criterion is a special betting system that is used exclusively for blackjack card counting. It is a formula that maximizes your profits and guides your better management. The main requirement to getting the biggest profits is you must have the mathematical edge over the house. The only way to get a mathematical edge is to practice card counting. If you are not card counting, then the Kelly criterion is useless.

History of the Kelly Criterion

The criterion is a mathematical formula invented by John Kelly while working at Bell Labs, Texas. The mathematics involved was derived through a study of probability theory and similar branches of mathematics. Technically, this theory isn't exclusive to gambling and blackjack. It can be used in a wide range of other applications such as the stock market, engineering and even quantum mechanics.

One of the most notable uses of the Kelly criterion was by Claude Shannon in the 1960's. He applied the theory to blackjack and even made a ton of money iin the stock market by utilizing the theory there as well. So if it is used correctly, there can be great success. Since then, the Kelly strategy can be seen in many other forms of gambling and other casino games. In fact, this strategy is sometimes known as Game Theory.

How to Use the Kelly Formula

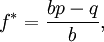

The Kelly formula is used to determine what fraction of the bankroll should be wagered based on different variables. Implementing this while card counting is very complicated and it takes much experience. You pretty much have to master card counting first before even beginning to comfortably implement the Kelly method. The formula is shown below:

Where:

- f* = fraction of bankroll to wager

- b = is the odds received on the wager, such as "3 to 2" odds (where b = 3 here)

- p = probability of winning (example: this number is 0.75 for a 75% probability)

- q = probability of losing, equal to 1 - p (example: q = 1-0.75 = 0.25)

Just find the variables b, p, and q. Then "plug" these numbers in place of the variables in the equation above and solve for f*. The fraction being found will maximize the money being won when using card counting. The number you are looking for is the probability of winning, which is extremely complicated to find. It's the actual edge that you have over the casino and this is always changing as the count changes. Although if you are one fine player who is good at math and you can find the edge, then the Kelly formula will maximize your profits.

Disadvantages of Kelly Criterion

The main drawback obviously is trying to calculate numbers like this in a casino environment. Also, the Kelly criterion doesn't guarantee a profit either. All it does is ensure that you correctly winning the biggest profit. Another drawback to the system is it's a long term process. It won't help you in the short term, but you will notice a huge change in the long term.

At the same time though, the criterion minimizes the chance for a complete lose of your bankroll. Basically, it doesn't actually improve your odds, it just ensures that you are getting the biggest "bang for the buck" or largest profit per bet. The theory initially assumes that you are card counting to begin with anyways. This is what gives you the blackjack edge over the casino.

Benefits When Using Kelly Strategy

The amazing part about using this formula is that you will build up compound interest in the long term by 9.07% when used perfectly. This means your profit is nearly ten percent higher by using this the Kelly strategy. More statistics show that there is only a 33% chance that you will lose half your bankroll before doubling it. If you are correctly counting cards, you should be guaranteeing yourself a profit in blackjack. So in the long run, you will be running a perfectly efficient system.

Half Kelly Criterion

One other thing I should point out is the half Kelly criterion sometimes used. Some players don't have enough faith in the criterion and often times make mistakes while trying to calculate the fraction formula. This is easy to understand because in a loud casino with lots of distractions and excitement, it's very difficult to be performing math problems in your head! So to compensate, blackjack players tend to bet too much money just to be safe. Instead, players end up losing money by doing this. Therefore players have cut their bets to half of what the Kelly criterion predicts, hence the name: half Kelly criterion.

The problem with doing the half Kelly bet is it ruins the whole point of even using the criterion. You won't be winning the maximum profit so there really is no point in doing it this way. The solution to this is to simply trust the mathematics and also learn how to perform these calculations in your head better to prevent mistakes.

US Players and Credit Card Deposits Accepted!

US Players and Credit Card Deposits Accepted!